Evergrande Debt Ratio

China Evergrande Groups debt to equity for the quarter that ended in Dec. Questions loom about a government bailout and whether Evergrande.

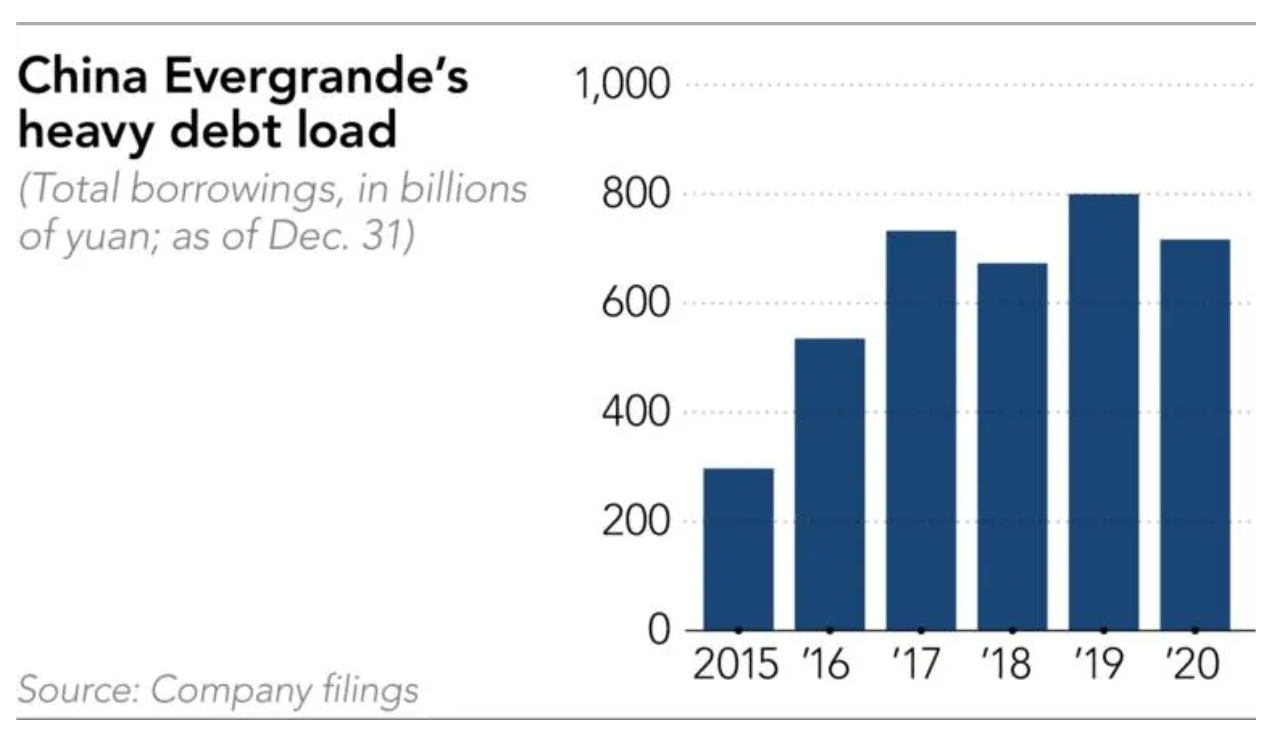

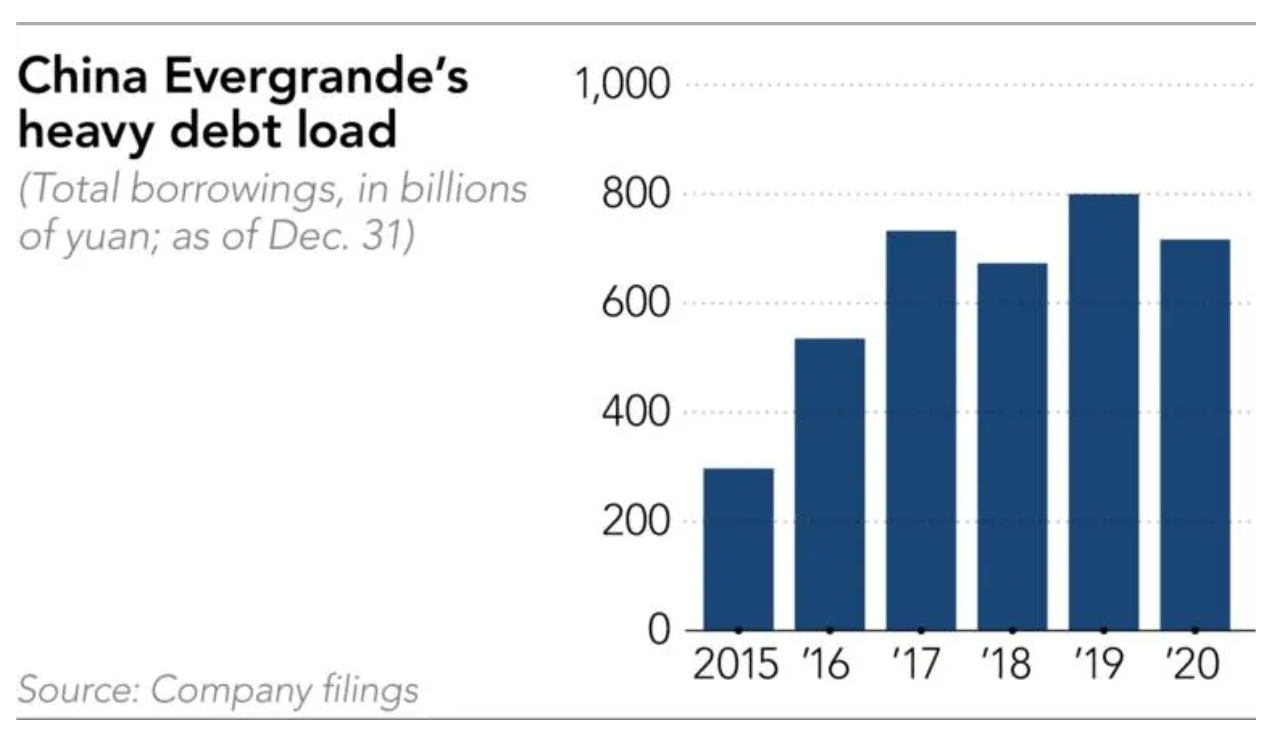

Chinas second largest Real Estate company Evergrande is over 305B in debt.

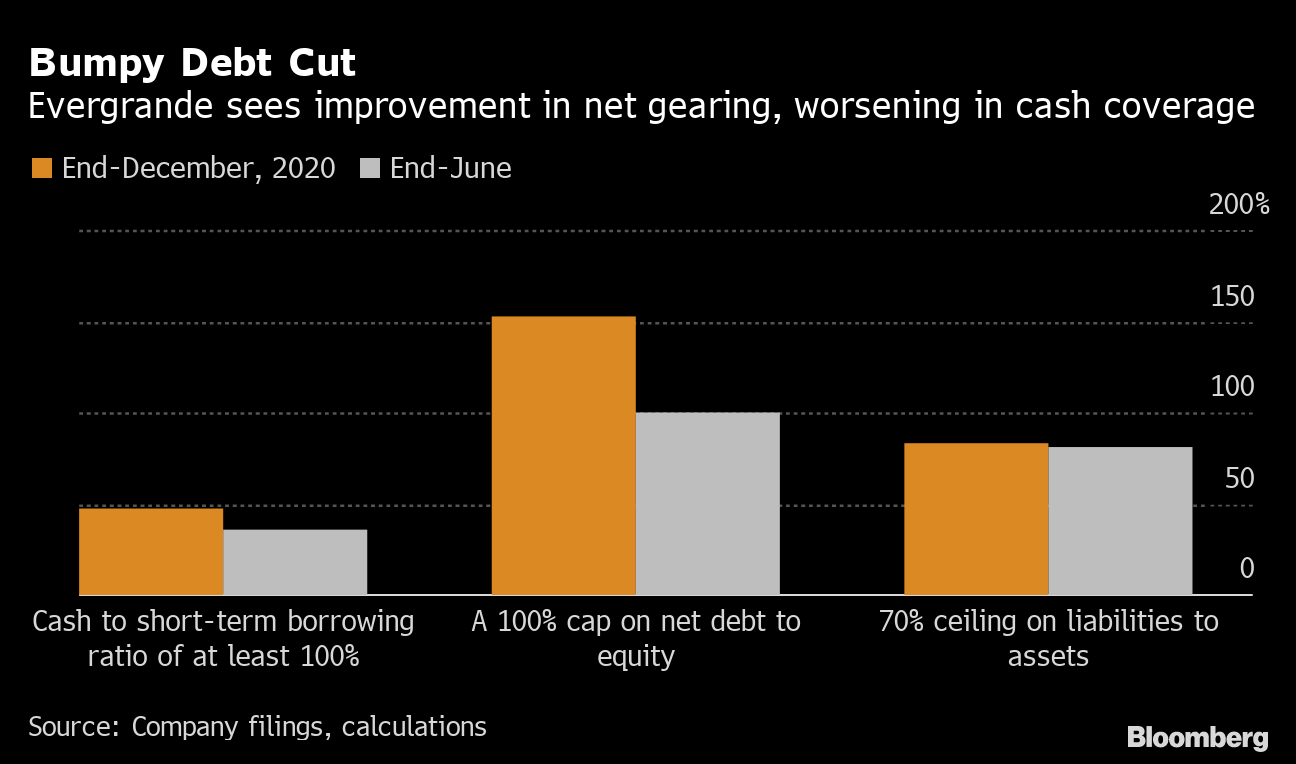

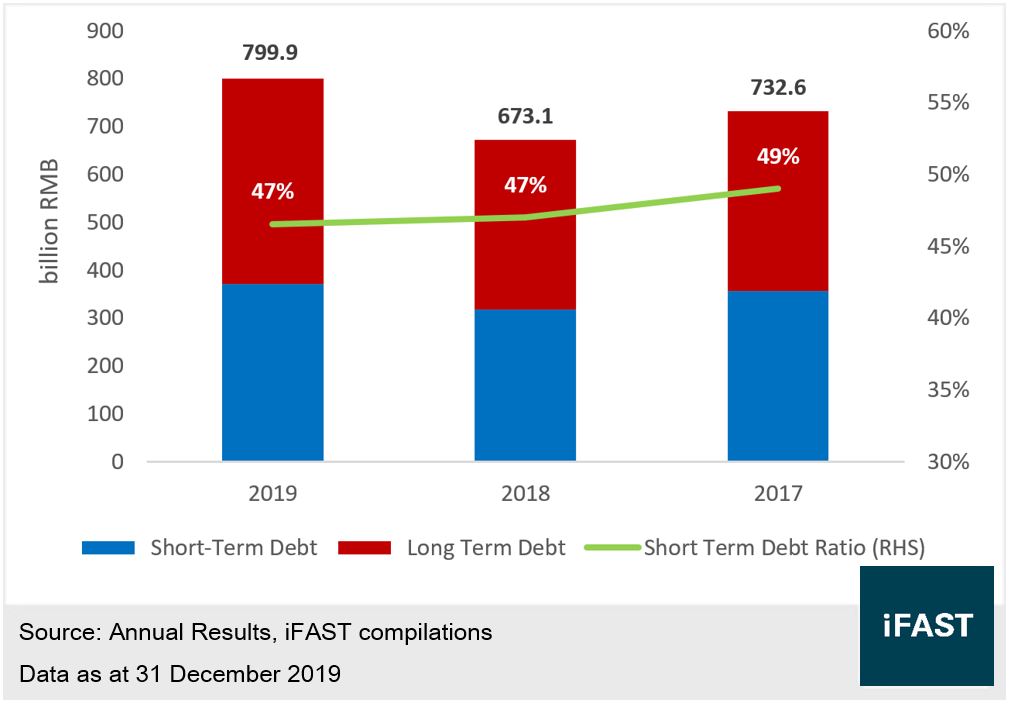

Evergrande debt ratio. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt. What it is and why it matters. A net gearing ratio of less than 100 and a cash-to-short-term debt ratio of at.

Chinas Evergrande debt crisis. As the company struggles to repay creditors Global markets have responded with selloffs. A high debt to equity ratio generally means that a company has.

Debt to Equity Ratio Definition. 2020 was 490.

China S Scrutiny Of Shadow Debt Bites Developers Like Evergrande Bloomberg

Evergrande Squeezed By 53 Billion Of Maturities In Tough Market

Moody S Downgrades Evergrande Despite Debt Relief Progress Caixin Global

China Evergrande Profit Drops As Developer Seeks To Ease Cash Crunch Bloomberg

Evergrande Seeks Safe Descent From Usd 130 Billion Debt Mountain Krasia

Evergrande Entering The Era Of Deleveraging Bondsupermart

/cloudfront-us-east-2.images.arcpublishing.com/reuters/65B7QMZXSVISHAHFEJEH6WDSAA.jpg)

Explainer How China Evergrande S Debt Woes Pose A Systemic Risk Reuters

0 Response to "Evergrande Debt Ratio"

Post a Comment